We believe the Webster Area is the best place to be in business and we look forward to working with you.

Currently, we work hand in hand with state, local and private groups to secure financing, business plans, structure and expansion for businesses wishing to start, relocate or expand in our area.

WADC has its own revolving loan fund as well thanks to funding through USDA Rural Development. We can provide low-interest, long-term loans to new or existing businesses in Day County. Contact our office today by phone (605-345-3159) or email.

Currently, we work hand in hand with state, local and private groups to secure financing, business plans, structure and expansion for businesses wishing to start, relocate or expand in our area.

WADC has its own revolving loan fund as well thanks to funding through USDA Rural Development. We can provide low-interest, long-term loans to new or existing businesses in Day County. Contact our office today by phone (605-345-3159) or email.

Tax Incentives

Day County Property Tax Abatement | Ordinance that offers a reduced tax rate for new industrial structures or additions for the first five years following construction. |

| Click to Enlarge |

Day County Work Opportunity Tax Credit | Provides tax credits to employers hiring workers that are between the ages of 18 and 40 in Day County (up to $2,400 per hire).

Reinvestment Payment Program | Reinvestment payments to projects in excess of $20,000,000, or with equipment upgrades in excess of $2,000,000.

South Dakota Jobs Program Grant | Assists with offsetting upfront costs associated with relocating or expanding operations (under $20 million) and/or upgrading equipment (under $2 million) in South Dakota.

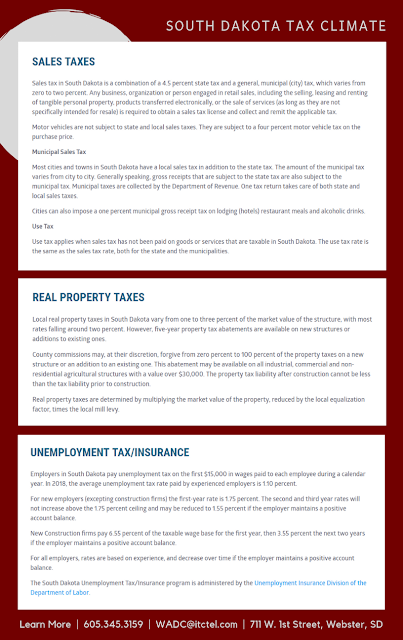

Tax Climate

Low Costs, Big Benefits | South Dakota's business climate is top in the nation for companies of all types from start-ups to major operations. Our state’s limited business taxes and costs give businesses a competitive edge by helping them keep the money they make so they can continue to invest in their company’s growth.South Dakota business owners benefit from:

- No corporate income tax

- No personal income tax

- No personal property tax

- No business inventory tax

- No inheritance or estate taxes

|

| Click to Enlarge |

- #1 Lowest State Tax Volatility | Pew Charitable Trusts 2017

- #2 Business Tax Climate | Business Facilities 2018

- #2 Best State for Small Business Taxes | Business News Daily 2017

- #2 Best State Tax Climate | State Tax Index 2018

- #4 Best State for Fiscal Stability | US News & World Report 2018

- #5 Low Tax Burden State | US News & World Report 2018

Workforce Incentives

- Dakota Seeds Grant | Provides matching funds (up to $2,000 per intern) for internships in the Science, Technology, Engineering and Math (STEM) fields, as well as in manufacturing and accounting.

- Workforce Development Grant | Offers up to 50% reimbursement (typically $500 per trainee) for eligible training expenses to companies that meet certain wage and benefit criteria.

Industrial Incentives

- Bond Financing Loan | Offers lower interest rates to borrowers for more capital-intensive projects through a pooled bond program through the Economic Development Finance Authority (EDFA). Eligible for-profit businesses are engaged in industrial operations, ag processing or manufacturing.

- Ethanol Infrastructure Grant | Provides matching funds for fuel retailers wishing to install pumps that disperse ethanol blends. Similarly, the Ethanol Storage Tank Program awards matching funds for the installation of an underground or above-ground storage tank that allows the blender pumps to be used.

- MicroLOAN South Dakota | Provides low-interest loan is available to South Dakota companies and residents and can finance amounts as little as $1,000 and as large as $100,000. Eligible uses include working capital, equipment, real estate or other fixed-asset project costs.

- Proof of Concept Loan / Grant | Provides up to $25,000 to conduct research that demonstrates the technical and economic feasibility of an innovation before it is commercialized. Investment proceeds may be used to pay consultant contracts, material and supplies, salaries for S.D. employees, and necessary services for technical feasibility or marketing studies.

- REDI Fund Loan | Provides low-interest loan for up to 45% of a project’s total cost. Ten percent minimum equity contribution required. Projects can include: land purchases; site improvements; construction, acquisition or renovation of a building; or to the purchase and installation machinery and equipment.

- South Dakota Works Loan | Flexible loan program that can finance up to $1 million of a project in a subordinated lien position. Lead lender required. Eligible uses include startup costs, working capital, payroll and construction on new buildings.

Agricultural Incentives

- Agribusiness Bond Program Loan | Assist in the development and expansion of agricultural and business enterprises with the State of South Dakota.

- Beginning Farmer Bond Program Loan | Assist Beginning Farmers in the state of South Dakota to acquire agricultural property at lower interest rates.

- Livestock Nutrient Management Bond Loan | Tax-exempt industrial revenue bond financing for processing or manufacturing and qualified environmental facilities.

- Livestock Loan Participation | Enable farmers and ranchers of limited equity to procure livestock loans at rates and terms which the applicant can reasonably be expected to meet and thereby utilize available feed, facilities, labor, and management skills.

- Rural Development Ag Loan Participation | Supplement existing credit in partnership with local lenders. Eligible costs include land needed for the project; buildings and improvements; and machinery/equipment.

- Value Added Agribusiness Relending Program Loan | Assist in community development projects, the establishment of new businesses, expansion of existing businesses, creation of employment opportunities or saving existing jobs, and adding value to South Dakota agricultural commodities through further processing or marketing.

- Value Added Livestock Underwriting (VALU) Guaranty | Enables qualifying farmers/ranchers the ability to borrow money from their local lender because through a 50% guarantee on a bank loan for livestock.

- Value Added Sub Fund (VASF) | Loans for agricultural development, feasibility studies, or marketing studies for new innovative agricultural development projects.

Additional Financing Partners

- Day County Champion Community | Provides low-interest loans for businesses in Day County, South Dakota.

- First Children's Finance | Provides loans and financial technical assistance to child care centers and family providers looking to expand or improve facilities and programs.

- GROW South Dakota | Provides affordable business financing to both new and existing businesses to purchase inventory, equipment or real estate. (Also known as NESDCAP and NESDEC)

- NECOG Development Corporation | Promotes and assists in the funding of small business start-ups, purchase of existing businesses, and expansion of businesses which, in all three instances, will create new or retain current jobs.

- ITC REDI Fund | Provides low-interest loans to businesses and communities for the purpose of adding value, employment and rural community opportunities. Proposals may include healthcare, environmental, educational and safety projects.

- REED Fund | Provides financing for business development and for projects involving infrastructure and quality-of-life elements necessary to assist rural communities to retain, develop and attract businesses.

Other Relevant Programs

- Community Development Block Grant | Helps develop viable communities by providing funds for a wide range of community needs, including water and wastewater infrastructure, community centers, medical centers, workforce training, senior centers; and for industrial infrastructure that will assist businesses creating new job opportunities for low- and moderate-income (LMI) individuals.

- Local Infrastructure Improvement Grant | Construct or reconstruct public infrastructure associated with an economic development project.

Learn More

- View Land and Building Opportunities in Day County, South Dakota >

- Reach Executive Director Melissa Waldner at (605-345-3159) or email.